| Content | Affiliate and Customers have added capability for taxability.

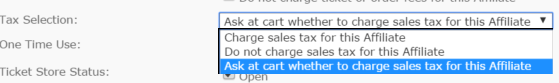

| Backend | Affiliate setups have the option to choose whether tax is charged, not charged, or selectable in the cart. This taxable field only applies to Tax1, most commonly referred to as Sales Tax.

|

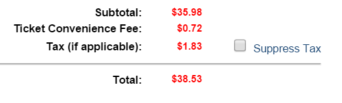

| Frontend | The “Ask at cart” option is new as of version 12.1.3 and is shown as a selectable option on the cart page if logged in.

|

| Option | Description | | 1. Charge sales tax for this Affiliate | Tax will be charged and there will be no option to suppress | | 2. Do not charge sales tax for this Affiliate | Tax will not be charged and there will be no option to suppress

| | 3. Ask at cart whether to charge sales tax for this Affiliate | A checkbox will be displayed when logged in as a management user on the cart to suppress tax. By default, this is unchecked (tax is charged) and when it is checked, the page will refresh and remove the tax. |

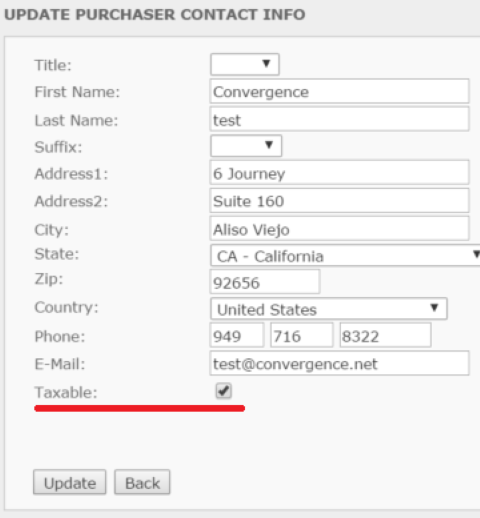

| Instructions | Screenshot | As of version 12.1.3, a new Taxable option was added to the customer information screen when edited from the order details page.

By default, this is checked (customer is taxable) – unchecking this and clicking update will set the customer record to non-taxable, remove the tax from the cart and update the order total. If this is checked again, it will reverse the changes and apply tax to the cart items and the update the total accordingly. An audit log is recorded every time this taxable setting is changed. This only applies to Tax1 (most commonly Sales Tax) |  |

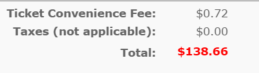

| Details | If the customer is set to non-taxable, the order details page will change the text from Taxes (if applicable) to Taxes (not applicable) and the tax amount will be 0.

|

|

|

|---|